This company has no active jobs

0 Review

Rate This Company ( No reviews yet )

Company Information

- Total Jobs 0 Jobs

- Category Other

- Location faisalabaad

- Address Gold Ira & Fredrick GmbH

About Us

Complete Study Report On Gold IRA Kits

Introduction

In recent years, the idea of investing in gold by Particular person Retirement Accounts (IRAs) has gained vital traction amongst buyers in search of to diversify their retirement portfolios. A Gold IRA Kit is a specialized package that provides people with the necessary instruments and sources to establish a self-directed IRA that allows for the investment in physical gold and other treasured metals. This report aims to explore the components, benefits, and issues related to Gold IRA Kits, offering a complete overview for potential investors.

Understanding Gold IRAs

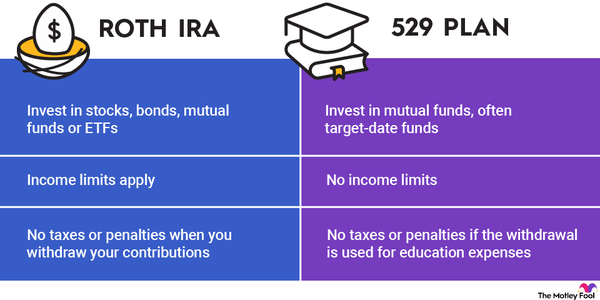

A Gold IRA is a kind of self-directed IRA that permits the inclusion of bodily gold and other valuable metals as part of the funding portfolio. Unlike conventional IRAs, which usually encompass stocks, bonds, and mutual funds, Gold IRAs supply a unique alternative to spend money on tangible belongings. If you beloved this write-up and you would like to receive far more details relating to best options for gold ira rollover kindly visit our web-page. The inner Revenue Service (IRS) has specific laws concerning the forms of metals that may be included in a Gold IRA, which typically embody gold, silver, platinum, and palladium.

Components of a Gold IRA Kit

A Gold IRA Kit usually contains a number of important components that facilitate the institution and management of a Gold IRA. These elements may fluctuate by provider however generally include:

- Instructional Materials: Most Gold IRA Kits come with comprehensive instructional sources that clarify the advantages of investing in gold, the technique of setting up a Gold IRA, and the IRS laws governing treasured metal investments.

- Account Setup Instructions: Detailed instructions on how one can open a self-directed IRA account with a custodian that specializes in precious metals.

- Custodian Information: An inventory of recommended custodians which can be IRS-authorised to carry bodily gold and other precious metals within an IRA.

- Storage Choices: Info on secure storage amenities for the bodily gold, usually in a third-party depository that meets IRS necessities.

- Funding Guides: Guides that outline the various kinds of gold merchandise eligible for IRA investment, including bullion coins, bars, and rounds.

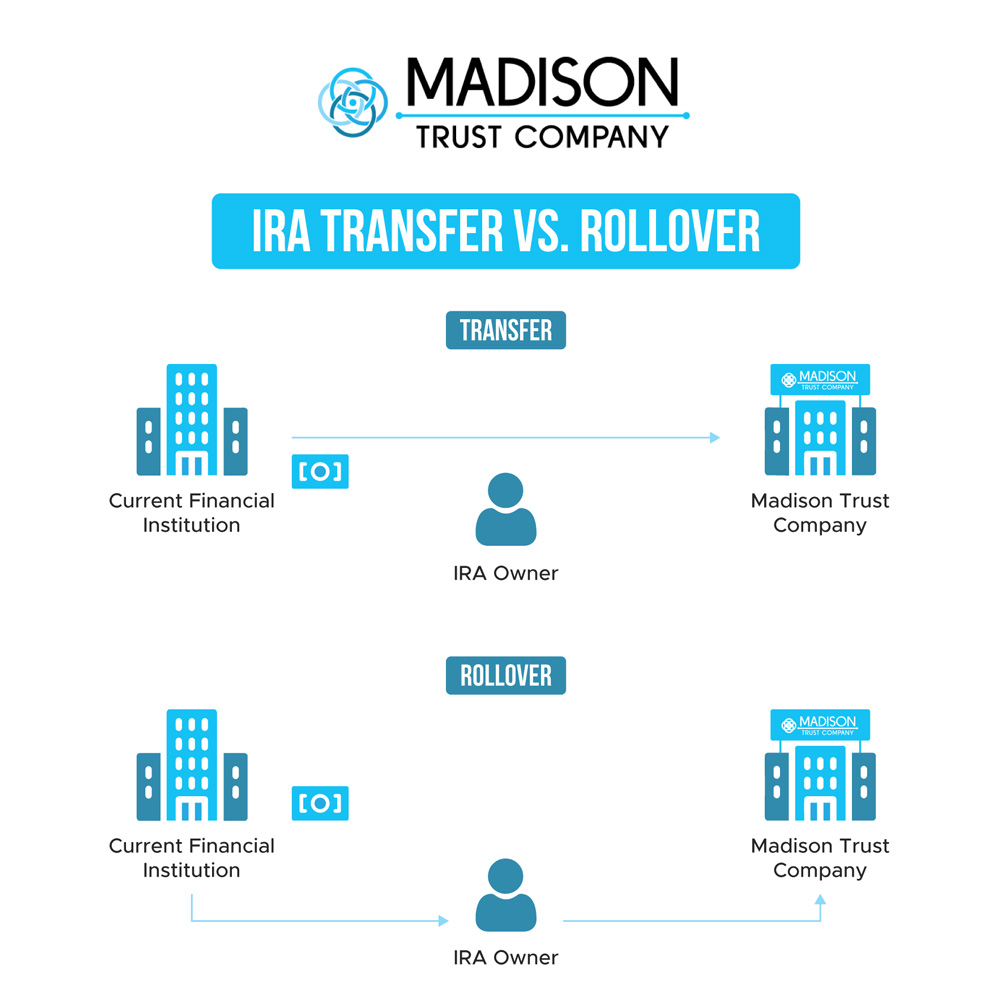

- Transaction Kinds: Obligatory types for initiating transactions, equivalent to purchasing gold, rolling over present retirement accounts, and transferring funds.

- Buyer Assist Information: Entry to customer support representatives who can help with questions and issues throughout the funding process.

Benefits of Investing in a Gold IRA

Investing in a Gold IRA via a Gold IRA Kit gives a number of advantages:

- Diversification: Gold serves as a hedge against inflation and economic downturns, offering a degree of security that conventional investments could lack.

- Tangible Asset: Unlike stocks and bonds, gold is a physical asset that traders can hold, which might be reassuring during times of market volatility.

- Tax Advantages: Gold IRAs offer the same tax advantages as conventional IRAs, allowing for tax-deferred growth on investments until withdrawal during retirement.

- Safety Towards Foreign money Fluctuations: Gold has historically maintained its worth even when fiat currencies expertise depreciation, making it a gorgeous possibility for preserving wealth.

- Legacy Planning: Gold may be passed all the way down to heirs, providing a tangible asset that can retain worth over generations.

Concerns When Choosing a Gold IRA Kit

While Gold IRA Kits provide quite a few benefits, potential investors should consider a number of components before proceeding:

- Custodian Charges: Totally different custodians charge varying charges for account setup, annual maintenance, and transaction processing. It is important to match these charges to ensure price-effectiveness.

- Storage Charges: Traders should also consider the costs associated with storing bodily gold, which might range based on the depository and the quantity of gold being saved.

- Market Volatility: Like every investment, the value of gold can fluctuate based mostly on market circumstances. Investors ought to be ready for potential value swings.

- IRS Laws: It’s essential to know the IRS rules surrounding Gold IRAs, together with the types of metals that qualify, to keep away from penalties.

- Investment Horizon: Gold is typically seen as a protracted-time period investment. Buyers ought to assess their financial goals and timelines earlier than committing to a Gold IRA.

How you can Get Began with a Gold IRA Kit

Getting began with a Gold IRA Kit includes a number of steps:

- Analysis Suppliers: Start by researching respected corporations that supply Gold IRA Kits. Search for customer reviews, industry rankings, and transparency in fees.

- Request a Gold IRA Kit: As soon as a supplier is chosen, request their Gold IRA Kit, which should embody all the necessary supplies mentioned earlier.

- Open an Account: Comply with the instructions provided within the package to open a self-directed IRA account with an accredited custodian.

- Fund the Account: Fund the account through contributions or rollovers from existing retirement accounts.

- Choose Investments: Select the sorts of gold and treasured metals to put money into based on the rules offered within the package.

- Safe Storage: Arrange for the secure storage of the bought gold in an IRS-authorized depository.

Conclusion

Gold IRA Kits supply a structured method for traders trying to diversify their retirement portfolios with bodily gold and other valuable metals. By offering academic materials, account setup instructions, and entry to custodians, these kits simplify the process of establishing a Gold IRA. While the benefits of investing in gold are compelling, potential traders should carefully consider the associated costs, IRS regulations, and market dynamics before proceeding. With the appropriate knowledge and sources, a Gold IRA can be a priceless addition to a retirement strategy, helping to preserve wealth and supply monetary security for the future.